The 4 Stages of the Real Estate Market Cycle

What are the 4 Stages of the Real Estate Market Cycle?

Where are we in the cycle?

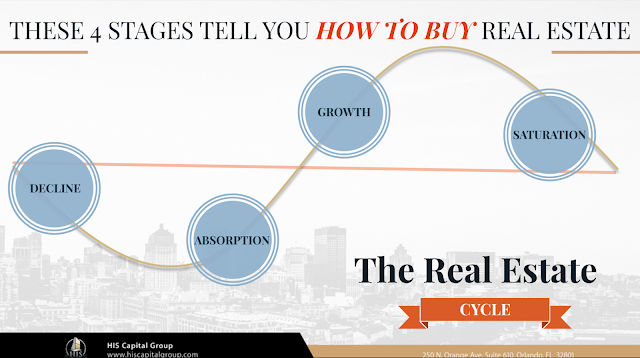

If you are a real estate investor, then your biggest and most important question should be. Where are we in the real estate cycle. What is happening now that could tell us where we are heading to in this roller coaster of property values. There are four key stages in the real estate cycle, Decline, Absorption, Growth and Saturation. Each one of these stages are driven by four indicators, vacancies, rents, the law of supply and demand. As we go through each one of these market cycle stages, we are going to focus on the supply and demand indicators and their activity so that we can identify how these indicators react through each stage.

Market Indicators: One of the best ways to test what is going on in the real estate market is by looking at the most important indicators. These indicators are, supply, demand, vacancy and rents. These four indicators change depending on the stage we are in during the real estate cycle and we can identify where we are by looking at how these four indicators react to what is happening locally and nationally today. For example, when there is a high demand for properties in a particular city or state and a lack of supply of good quality properties, the houses tend to rise. When there is no demand for housing due to a weak economy and an oversupply of properties is available, the prices of houses tend to fall.

Let's break down each one of the stages in the real estate cycle and how these four indicators that we just described react during these stages and use recent examples of our most recent real estate experiences to identify each stage.

DECLINE STAGE

We just experienced one of the most drastic examples of declining values in real estate history. Housing prices peaked in early 2006 and started to decline in late 2006 and early 2007. It is evident that new construction homes were expanding faster than demand, particularly in many areas in Florida, California, Nevada among others from 2005 through 2007. The increased in foreclosure rates that started in 2006-2007 caused an increase in demand of properties and the real estate bubble crisis burst in October 2007. From there, the direct impact extended beyond just home values, home builders were affected, home supply retail outlets, institutional investors, national and foreign banks and pension funds enlarged this recession into an international crisis.

DECLINE: Investment Strategies

The most common strategy during the decline stage of the real estate market is an opportunistic play. At this phase in the cycle the strategy has to do more with pricing since the recession will create a panic atmosphere and can provide for multiple opportunities where other operators, investors and owners are unable to operate. At this point, having access to capital plays the most crucial role since capital restrictions is the most common cause for the panic and capital superiority creates the best opportunity.

______________________________________________________________________________

ABSORPTION STAGE

The absorption stage in the real estate cycle comes right after the bottom of the depression. The bottom of the real estate market happened in 2012, five years after the market hit its peak in 2007. In 2012, we started to see a slight correction in supply with more limited properties hitting the market as REO's continued to dry up. This caused demand to begin to increase but remained very flat since lending guidelines remained strict allowing only a limited amount of consumers to participate in the home buying activities. Vacancies, specially in commercial real estate started to see a more balanced rate and in some areas rent rates began to increase. In residential real estate, rents increased since home owners that lost their homes since 2007 became tenants and the amount of demand for rental homes surpassed the available supply particularly in major real estate markets.

ABSORPTION: Investment Strategies

The best investment strategies for this stage are opportunistic and value added plays. Holding periods are usually 3-5 years expecting to exit during the growth stage of the real estate cycle. Holdings strategies should also consider longer holding periods as stronger rental rates will only begin to show positive expansion during the growth stage.

______________________________________________________________________________

GROWTH STAGE

GROWTH STAGEDuring this growth stage the market begins to see a positive outlook in terms of expansion. Demand begins to increase and the limited amount of inventory available continues to be greater than the actual supply. Vacancies decline to new lows and rents begin to have positive growth. We have been able to see the beginning of this limited growth stage in late 2016 and early 2017 and it should continue to rise for at least the next three to five years. Financial speculation will play a crucial role during this stage as we begin to move towards the aggressive push in demand. Banks will begin to display signs of amnesia as they forget mistakes from the past and return to relaxed credit guidelines. New mortgage products will begin to prompt old memories from the sub-prime lending years, allowing new market participants to carry the weight of this cycle stage all the way to the top.

GROWTH: Investment Strategies

New construction is one of the best strategies during this stage. The current demand for housing and leasing becomes the perfect opportunity for experienced developers to capitalize at this point. More sophisticated operators and developers are also able to capture distressed assets with multiple deficiencies at much lower price and once stabilized reach the asset's full value for disposition.

______________________________________________________________________________

SATURATION STAGE

This is where most people make mistakes in the market place going away from balanced investment philosophies and end up paying the price. The increase of supply is much greater than the demand. Developers cannot sell their homes so they use different incentives to attract buyers in order to move inventory. This is where back in 2005 through 2007 builders started using different marketing techniques to attract buyers with gifts, vehicles, upgrades and other bonuses. Vacancies begin to increase and rent rates start to fall creating an opportunity for builders to negotiate apartment complexes in order to convert them into condos and satisfy the slowing demand.

SATURATION: Investment Strategies

This is a great time to buy distressed assets specially from banks through short sales or foreclosures. This strategy works best with access to patient capital that can withstand the saturation and decline stages and wait for the wind to change with a plan to liquidate during the growth stage.

______________________________________________________________________________

2017 IN THE REAL ESTATE CYCLE:

MACROECONOMIC VIEW :

The nation's largest property database ATTOM Data Solutions recently released information regarding foreclosures stating that .70 percent of all housing units in the US had a foreclosure filling. That is the lowest annual foreclosure rate nationwide since 2006. Foreclosures, Notices of Default, Auction notices are also at the lowest level since 2006. All of this confirms what we can sense in the market based on supply and demand. There is a very limited amount of supply that is pushing home prices up with the also limited amount of demand since lending requirements are still very strict. The main reason we see prices going up today, is because of this shortage in the supply of homes available for the also limited buyers but nonetheless demand is still stronger than supply. The few qualified buyers that are credit worthy and with the ability to show their finances to qualify for conventional loans are still absorbing this limited supply proving that demand is still stronger than the supply. We have not even began to see the demand increase due to financial innovation when banks begin to lend aggressively as their capital is released in the market place. This financial innovation is just starting to unfold. We can now see more aggressive loan programs that begin to hit the market place. Programs that qualify buyers based on bank statements only, lower FICO requirements, higher debt to income ratios, less down payment or down payment assistance programs and other loan programs that allow even recent short sales or bankruptcies to be considered for a loan. This is just the tip of the iceberg as we continue to see lenders become more and more aggressive trying to originate loans from both private and institutional capital sources.

REAL ESTATE OUTLOOK:

The real estate market could still see home prices go up for the next 3 to 5 years. The US Economy has very slow growth of 2 percent for 2017 and many factors can determine the direction that the economy goes for 2018. From 2006 until the 3rd quarter of 2016, we were technically under an economic recession according to the Vanguard Research. By late 2016, we shifted from a pessimistic outlook towards an overly optimistic expectation of growth which is a more common topic in main street and wall street today. Historically, in the US every 40 years we have had a major recession that lasts a decade. It happened in the 1890s, then in 1930s which went on for 15 years, 1971 getting off the gold standard and printing 20 million of cash per day and now in the 2010s printing 3.3 billion of cash per day for multiple stimulous package.

Where did all that money go?

Banks kept the money, they repaid the stimulous packages but they did not lend money to consumers because the economy was not growing fast enough for them to feel comfortable lending again. But yet, banks tripled and even quadrupled their assets after the bail out. Banks are sitting on bags of cash literally but they have not began to lend that money out until they begin to feel comfortable with economic growth. The Federal Reserve Bank of the US will continue to increase interest rates in order to control inflation but they cannot increase them too high, can they? Even a 1% increase in rates could directly affect our annual federal budget deficit by $200 Billion, so the Federal Reserve and our government have to be very careful as they juggle interest rate increases with annual budget deficits.

If you want to find out more details about our outlook on housing and the global economy, click on the link below and receive a FREE Economic Outlook for 2017.

To receive a copy of our FREE Economic Outlook, CLICK HERE

CONCLUSION:

The real estate cycle varies based on geographical location and also based on the asset type. Certain markets tend to be the leaders that trigger the activity 1-2 years before other markets are able to follow. California tends to be a trend setter in this type of activity being at least 1-2 years ahead of others states in the stages of the real estate cycle. Having a balanced investment portfolio is the best strategy that you could have in order to protect yourself against stage change in the cycle. HIS Capital Group believes in the 40-40-20 strategy, a balanced investment strategy composed of appreciating assets, cash flow and high-risk-high-reward investments. If you want to learn more about how to create a balanced investment strategy, please visit HISCapitalGroup.com

Comments

Post a Comment